Can I Deduct Home Office In 2024 Calendar – Tax season officially kicks off on January 29, 2024. Taxpayers can file anytime between Monday classified as “employees” to deduct home office expenses. You must be a business owner. . Try this easy ‘activity’ that can dramatically lower your risk Why making your bed is much more important than you think In which countries do people spend most on weddings? .

Can I Deduct Home Office In 2024 Calendar

Source : www.facebook.comWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.comThrasher CPA, LLC

Source : m.facebook.com2024 Federal Tax Calendar | Bloomberg Tax

Source : pro.bloombergtax.comSenior Insurance Advisory Services, Inc | West Monroe LA

Source : www.facebook.comIRS Announces 2024 Tax Season Start Date, Filing Deadline | Money

Source : money.com2024 IRS Tax Deadlines Filing Calendar

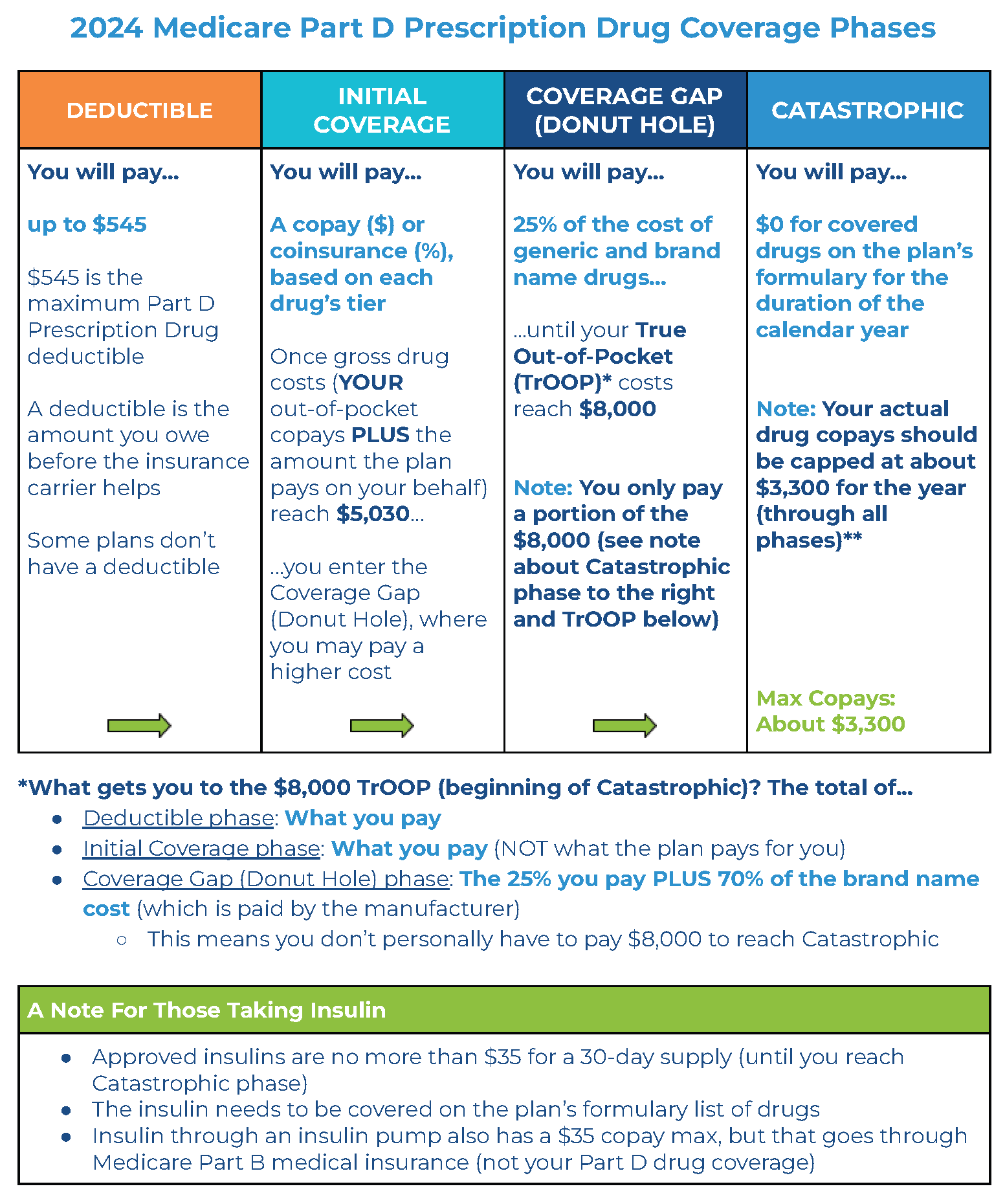

Source : www.aarp.orgHow Medicare Part D Works (2024) — Medicare Mindset, LLC

Source : www.medicaremindset.comStart tracking your hours! The Town Enfield Town Manager

Source : m.facebook.comHome Office Tax Deduction 2024 Blog Akaunting

Source : akaunting.comCan I Deduct Home Office In 2024 Calendar Keystone CPA, Inc. | Fullerton CA: The way people work changed during the pandemic, and even though most companies have reopened their offices, many employees still do some work from home. Some work on a hybrid schedule with three . To deduct your mortgage interest, you’ll need to fill out IRS Form 1098, which you should receive from your lender in early 2024 1040 Schedule A. Home office expenses can be deducted if .

]]>